Building Wealth Through Home Equity: A Practical Guide

Your Home: More Than Just Where You Live

Every mortgage payment builds equity. Every year of appreciation grows wealth. Here's how to think about your home as an investment vehicle.

How Home Equity Builds

Equity comes from two sources:

- Principal paydown: Each mortgage payment reduces what you owe

- Appreciation: Property values historically increase over time

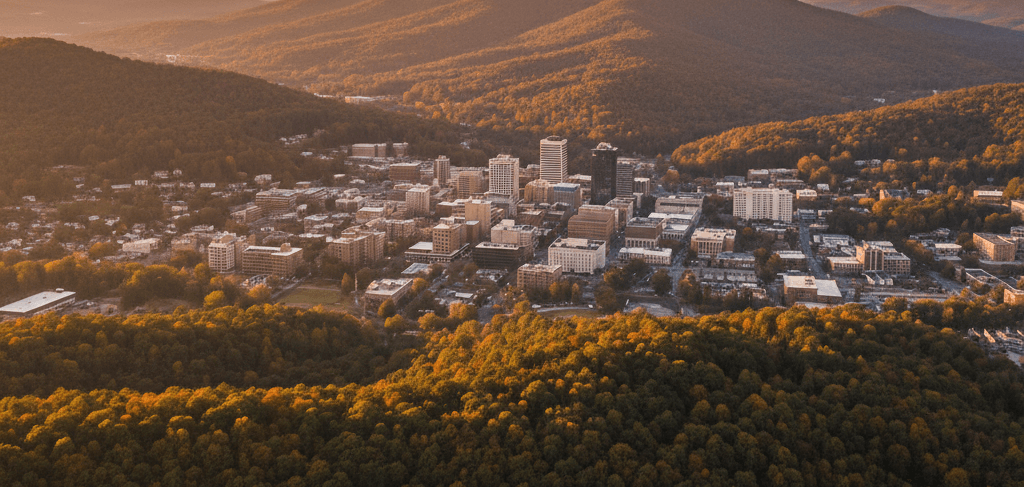

In Roanoke, homes have appreciated steadily, though past performance doesn't guarantee future results.

The Forced Savings Effect

Renters pay a landlord. Homeowners pay themselves. That mortgage payment is forced savings—money you'd spend on housing anyway that instead builds your net worth.

Strategies to Accelerate Equity Building

- Extra principal payments: Even $100/month extra shortens your loan and builds equity faster

- Bi-weekly payments: 26 half-payments per year = 13 monthly payments, not 12

- Value-add improvements: Strategic upgrades that increase appraised value

- Avoid cash-out refinancing: Unless using funds for investments with higher returns

Leveraging Home Equity

Once you've built equity, you can:

- Fund home improvements that increase value further

- Consolidate high-interest debt (use carefully)

- Invest in additional real estate

- Use as collateral for business financing

The Long Game

Real estate wealth builds over decades, not months. Those who bought in Roanoke 20 years ago have seen tremendous equity growth. Those buying today position themselves for similar long-term gains.

Ready to start building equity? Explore your buying options.

Robert Krause

Licensed REALTOR®

With years of experience in the Roanoke Valley real estate market, Robert helps families find their perfect homes and guides sellers to successful closings.

Get in touch →Related Posts

January 25, 2026